NC DoR D-400V 2008-2024 free printable template

Show details

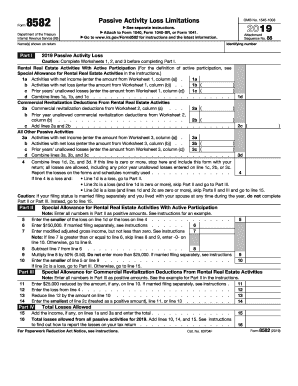

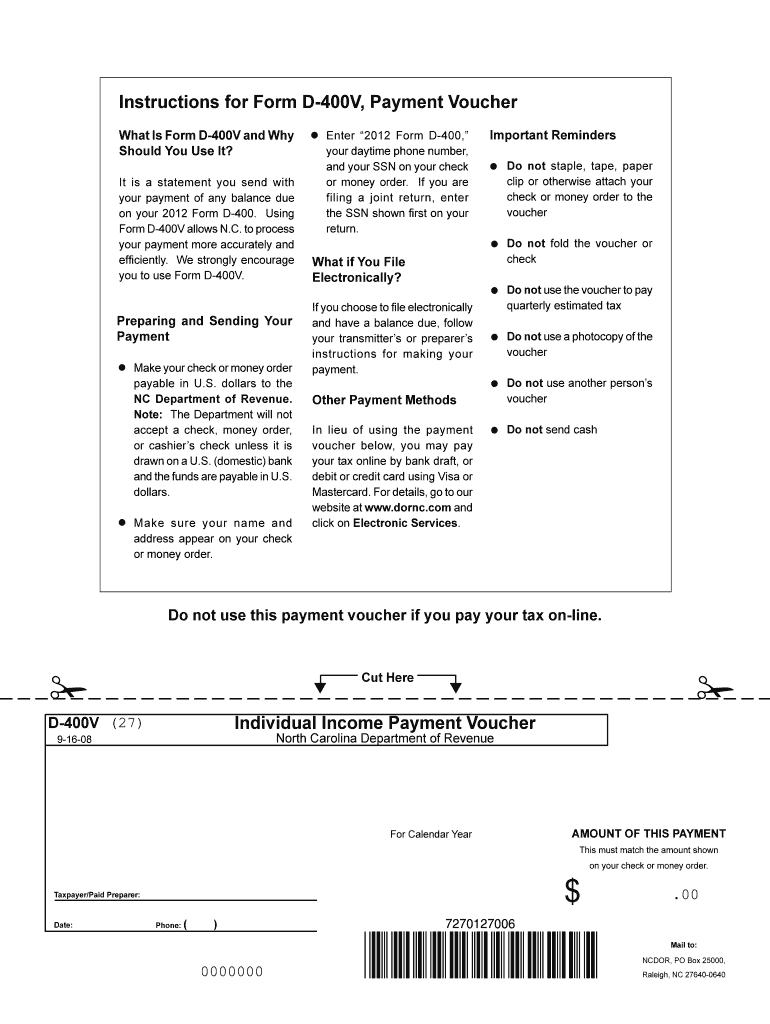

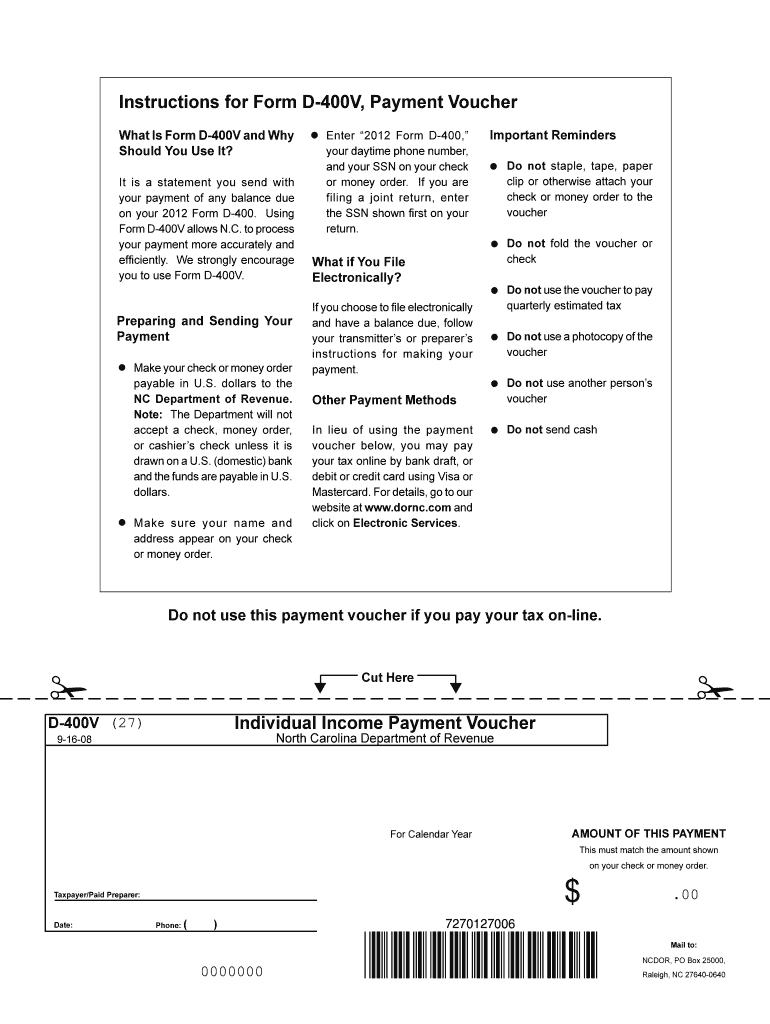

Using Form D-400V allows N.C. to process your payment more accurately and efficiently. We strongly encourage you to use Form D-400V. Instructions for Form D-400V Payment Voucher What Is Form D-400V and Why Should You Use It It is a statement you send with your payment of any balance due on your 2012 Form D-400. Cut Here Individual Income Payment Voucher D-400V 27 North Carolina Department of Revenue 9-16-08 For Calendar Year AMOUNT OF THIS PAYMENT This must match the amount shown...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your nc d 400v printable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nc d 400v printable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nc d 400v printable form online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit d 400v form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

How to fill out nc d 400v printable

How to fill out nc d 400v printable:

01

Download or obtain the nc d 400v printable form from a reliable source.

02

Read the instructions carefully to understand the requirements for filling out the form.

03

Gather all the necessary information and documents needed to complete the form. This may include personal identification details, income information, and any applicable deductions or credits.

04

Start filling out the form by entering your personal information, such as your name, address, and social security number.

05

Follow the instructions provided to accurately report your income from various sources, such as wages, interest, dividends, and self-employment income.

06

If applicable, claim any deductions or credits that you qualify for by carefully following the provided guidelines. This may include deductions for student loan interest, mortgage interest, or medical expenses, among others.

07

Double-check all the information you have entered to ensure it is accurate and complete.

08

Sign and date the form in the designated area.

09

Make a copy of the completed form for your records.

10

Submit the nc d 400v printable form by the designated deadline, either by mail or electronically, depending on the instructions provided.

Who needs nc d 400v printable:

01

Individuals who are required to file a North Carolina state tax return.

02

Individuals who have income from North Carolina sources, even if they are not residents of the state.

03

Individuals who are eligible for any specific deductions or credits offered by the state of North Carolina.

04

Individuals who want to report their income accurately and fulfill their tax obligations in North Carolina.

05

Anyone who prefers using a printable form rather than filing their taxes electronically.

Note: It is always recommended to consult with a tax professional or refer to the latest tax laws and regulations to ensure accuracy and compliance when filling out tax forms.

Video instructions and help with filling out and completing nc d 400v printable form

Instructions and Help about d 400v individual income payment voucher form

Fill nc d400v : Try Risk Free

People Also Ask about nc d 400v printable form

Can I download and print tax forms?

Can I download IRS tax forms?

Where can I get NC State Tax Forms?

Does North Carolina have an eFile form?

What is NC form D 400v?

Is North Carolina accepting eFile returns?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is nc d 400v printable?

NC D 400V printable is a type of printable label designed to be used with NC D 400V thermal transfer ribbon. The label is designed specifically for use with NC D 400V ribbon, which is a specialized ribbon used for printing on textiles. The label is made of a durable, waterproof material that is resistant to most chemicals, solvents, and abrasions. It is ideal for labeling textiles and other materials.

What is the purpose of nc d 400v printable?

The purpose of "nc d 400v printable" is to provide a printable version of 400V-rated non-combustible electrical conduit. It is used in electrical installations where a non-combustible conduit is required for safety reasons.

Who is required to file nc d 400v printable?

Individuals who are residents of North Carolina and have a taxable income are required to file the NC D-400V form. The NC D-400V is the Individual Income Tax Payment Voucher. It is used to make estimated tax payments or to pay any outstanding tax liabilities. The form is usually filed along with the NC D-400 form, which is the North Carolina Individual Income Tax Return.

How to fill out nc d 400v printable?

To fill out an NC D-400V form (Payment Voucher for Income Tax), follow these steps:

1. Obtain the NC D-400V form: You can find a printable version of the form on the official North Carolina Department of Revenue website or through a reliable tax preparation software.

2. Provide your personal information: Enter your name, Social Security Number (SSN), and the tax year for which you are making the payment.

3. Enter your contact information: Fill in your current mailing address, city, state, and ZIP code.

4. Compute your tax liability: Calculate the total income tax amount you owe for the tax year. You can do this by referring to your completed NC D-400 tax return or using the tax rate schedule provided with the form instructions.

5. Enter the payment details: Fill in the total tax amount you calculated in Step 4 in the "Amount remitted" field.

6. Determine the payment method: Choose the mode of payment you prefer, such as check, money order, electronic fund transfer, etc.

7. Make a copy: For your records, make a copy of the filled-out form and any supporting documentation, such as receipts or payment confirmations.

8. Submit your payment: Mail the completed payment voucher and your payment (check or money order) to the address mentioned on the form. If you choose to pay electronically, follow the instructions provided on the form.

Please note that this is a general guide, and it is advisable to refer to the official instructions accompanying the form or consult with a tax professional if you have specific questions or unique circumstances.

What information must be reported on nc d 400v printable?

The NC D-400V form, also known as the Individual Income Payment Voucher, is used to submit payment for any balance due on an individual's income tax return. The information that must be reported on the NC D-400V includes:

1. Taxpayer Name: The full name of the taxpayer making the payment.

2. Social Security Number: The taxpayer's Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

3. Tax Year: The year for which the payment is being made (e.g., 2021).

4. Filing Status: The taxpayer's filing status (e.g., Single, Married Filing Jointly, Head of Household, etc.).

5. Address: The taxpayer's complete mailing address, including street, city, state, and ZIP code.

6. Email Address: The taxpayer's email address (optional).

7. Phone Number: The taxpayer's contact phone number (optional).

8. Tax Liability: The total amount of tax liability owed for the tax year being filed.

9. Payments: The total amount of estimated tax payments and any credits applied towards the tax liability.

10. Penalties and Interest: If applicable, any penalties or interest owed should be reported separately.

11. Total Amount Due: The sum of tax liability, penalties, and interest (if applicable).

12. Payment Details: The payment method used (e.g., check, money order, credit/debit card), payment amount, and check or money order number (if applicable).

13. Signature: The taxpayer must sign and date the form to authorize the payment.

It is important to note that the NC D-400V form is only for payment submission; taxpayers must also file their corresponding NC D-400 or NC D-400TC tax return separately.

What is the penalty for the late filing of nc d 400v printable?

In North Carolina, the penalty for late filing of the NC D-400V (Payment Voucher for E-Filed Income Tax Returns) may vary depending on the circumstances. The penalty for late payment is generally 5% of the unpaid tax per month or part of a month, up to a maximum of 25% of the unpaid tax. Additionally, interest will accrue on the unpaid tax at a rate determined by the North Carolina Department of Revenue.

It is always recommended to file tax documents on time to avoid penalties and interest charges. If you have specific questions or concerns about your situation, it is advisable to consult with a tax professional or contact the North Carolina Department of Revenue for more information.

How can I send nc d 400v printable form to be eSigned by others?

To distribute your d 400v form, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I edit form d 400v in Chrome?

nc d 400v payment voucher can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I edit nc form d 400v on an Android device?

You can make any changes to PDF files, such as nc d 400v form, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

Fill out your nc d 400v printable online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form D 400v is not the form you're looking for?Search for another form here.

Keywords relevant to d400v form

Related to d400v printable

If you believe that this page should be taken down, please follow our DMCA take down process

here

.